|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

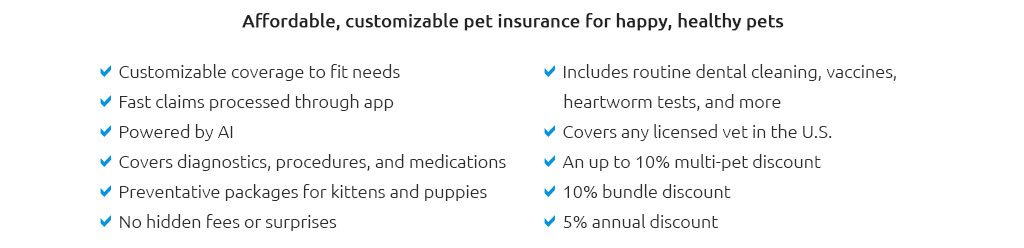

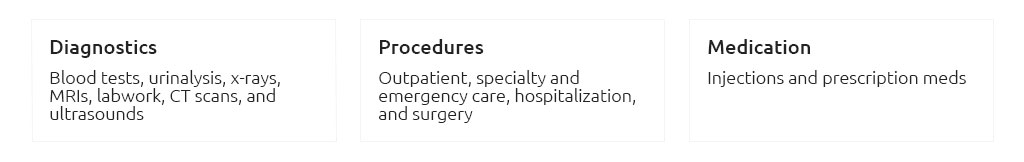

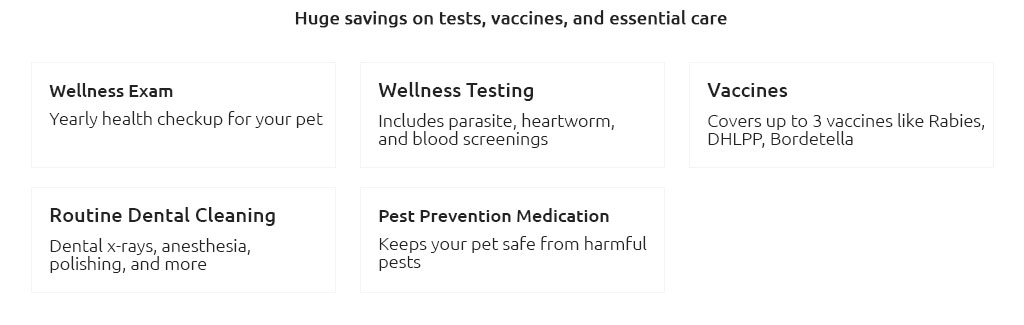

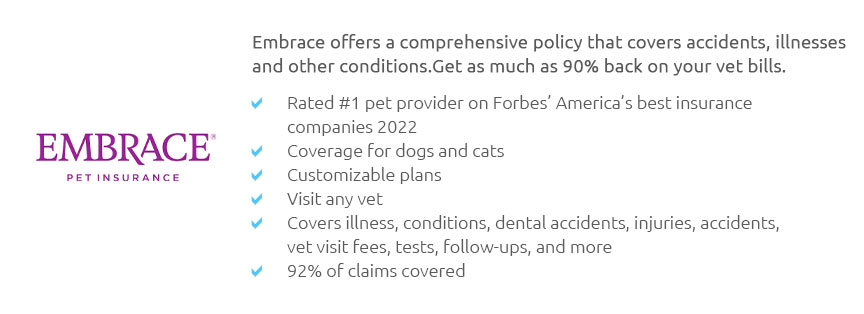

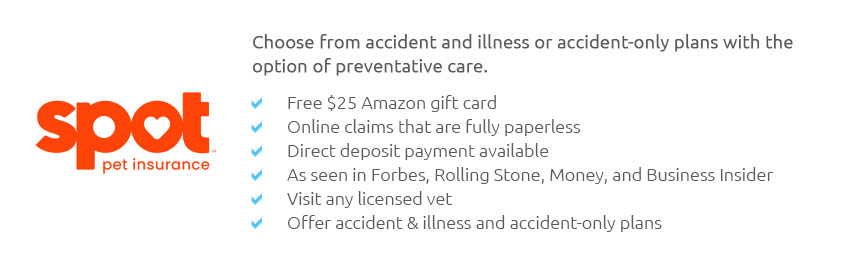

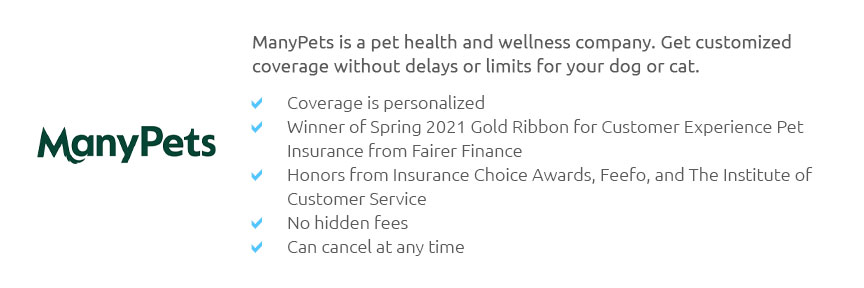

what is the best dog insurance for your pup todayDefining “best” for your dogThe “best” policy isn’t a brand name; it’s the plan that fits your dog’s age, breed risks, and your budget and risk tolerance. Look for broad accident and illness coverage, hereditary and chronic conditions, and consider exam fees, prescriptions, and emergency care. Read the fine print-waiting periods, exclusions, and caps matter more than glossy ads. What to compare before you buyAim for clear terms, predictable costs, and a smooth claims experience. A good policy should explain how it pays, what it excludes, and how quickly it reimburses. Independent ratings and vet referrals help you avoid surprises.

Shortlist top-rated insurers, get 2–3 quotes with identical limits, and pick the highest coverage you can comfortably afford; don’t delay-pre-existing conditions aren’t covered.

|